Chapter 12 – Third-Party Rights

12.4 Third-Party Beneficiaries

With assignments and delegations, we observed situations in which third-parties were brought into a pre-existing contract. An intended third-party beneficiary, on the other hand, is a party that was considered at the time the contract was made, and is part of the purpose for the contract in the first place. A party to a contract cannot enforce its terms; but if the party is intended to benefit from the performance of a contract between others, it makes sense that they should be able to enforce the contract.

Two Types of Third-Party Beneficiaries

In the vocabulary of the Restatement, a third person whom the parties to the contract intend to benefit is an intended beneficiary—that is, one who is entitled under the law of contracts to assert a right arising from a contract to which he or she is not a party. There are two types of intended beneficiaries.

Creditor Beneficiary

A creditor beneficiary is one to whom the promisor agrees to pay a debt of the promisee. For example, a father is bound by law to support his child. If the child’s uncle (the promisor) contracts with the father (the promisee) to furnish support for the child, the child is a creditor beneficiary and could sue the uncle. Or again, suppose Customer pays Ace Dealer for a new car, and Ace delegates the duty of delivery to Beta Dealer. Ace is now a debtor: he owes Customer something: a car. Customer is a creditor; she is owed something: a car. When Beta performs under his delegated contract with Ace, Beta is discharging the debt Ace owes to Customer. Customer is a creditor beneficiary of Dealers’ contract and could sue either one for nondelivery. She could sue Ace because she made a contract with him, and she could sue Beta because—again—she was intended to benefit from the performance of Dealers’ agreement.

Donee Beneficiary

The second type of intended beneficiary is a donee beneficiary. When the promisee is not indebted to the third person but intends for him or her to have the benefit of the promisor’s performance, the third person is a donee beneficiary (and the promise is sometimes called a gift promise). For example, an insurance company (the promisor) promises to its policyholder (the promisee), in return for a premium, to pay $100,000 to his wife on his death; this makes the wife a donee beneficiary. The wife could sue to enforce the contract although she was not a party to it.

Incidental Beneficiary

If a person is not an intended beneficiary—not a creditor or donee beneficiary—then he or she is said to be only an incidental beneficiary, and that person has no rights. An incidental third-party beneficiary is a party who may actually benefit from a contract between two other parties, but that benefit is like a side effect of the contract, because the contract itself was not specifically intended to benefit them. In other words, the third party is not a direct party to the contract but might still receive some benefits from the contract if it is performed as intended. Incidental beneficiaries have no legal right to enforce the contract or sue for damages if the contract is breached.

The beneficiary’s rights are always limited by the terms of the contract. A failure by the promisee to perform his part of the bargain will terminate the beneficiary’s rights if the promisee’s lapse terminates his own rights, absent language in the contract to the contrary.

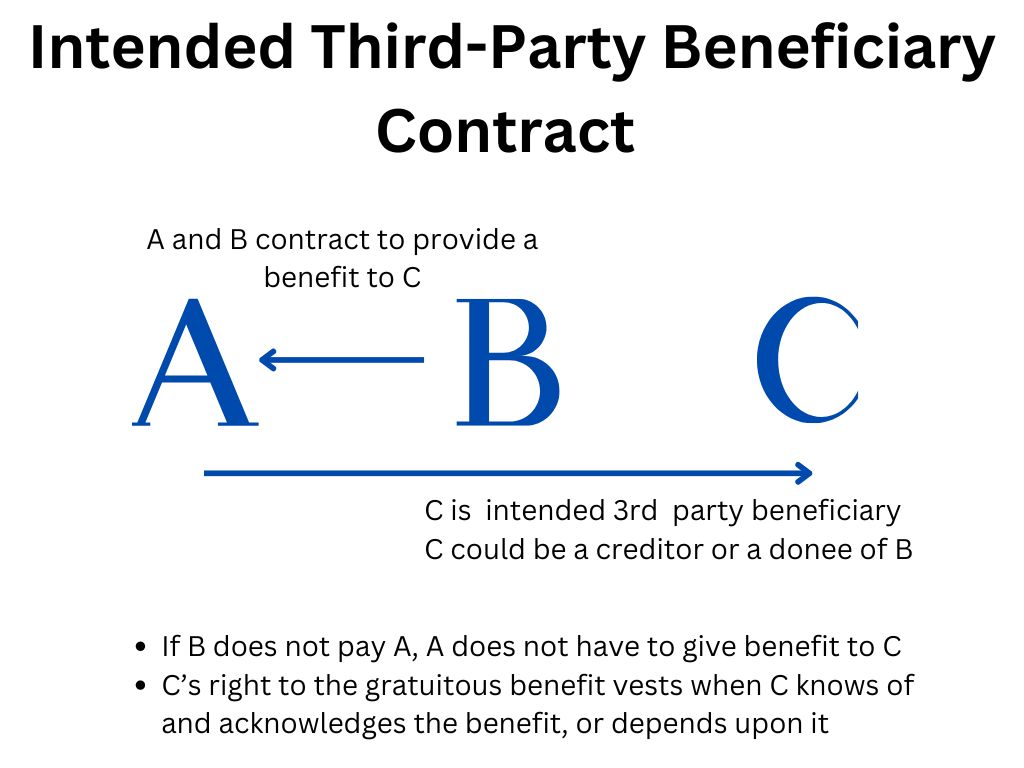

Figure 12.1

Modification of the Beneficiary’s Rights

Conferring rights on an intended beneficiary is relatively simple. Whether his rights can be modified or extinguished by subsequent agreement of the promisor and promisee is a more troublesome issue. The general rule is that the beneficiary’s rights may be altered as long as there has been no vesting of rights (the rights have not taken effect). The time at which the beneficiary’s rights vest differs among jurisdictions: some say immediately, some say when the beneficiary assents to the receipt of the contract right, some say the beneficiary’s rights don’t vest until she has detrimentally relied on the right. The Restatement says that unless the contract provides that its terms cannot be changed without the beneficiary’s consent, the parties may change or rescind the benefit unless the beneficiary has sued on the promise, has detrimentally relied, or has assented to the promise at the request of one of the parties. Some contracts provide that the benefit never vests; for example, standard insurance policies today reserve to the insured the right to substitute beneficiaries, to borrow against the policy, to assign it, and to surrender it for cash.

Video on Third-Party Beneficiaries

Government Contracts

The general rule is that members of the public are only incidental beneficiaries of contracts made by the government with a contractor to do public works. It is not illogical to see a contract between the government and a company pledged to perform a service on behalf of the public as one creating rights in particular members of the public, but the consequences of such a view could be extremely costly because everyone has some interest in public works and government services.

A restaurant chain, hearing that the county was planning to build a bridge that would reroute commuter traffic, might decide to open a restaurant on one side of the bridge; if it let contracts for construction only to discover that the bridge was to be delayed or canceled, could it sue the county’s contractor? In general, the answer is that it cannot. A promisor under contract to the government is not liable for the consequential damages to a member of the public arising from its failure to perform (or from a faulty performance) unless the agreement specifically calls for such liability or unless the promisee (the government) would itself be liable and a suit directly against the promisor would be consistent with the contract terms and public policy. When the government retains control over litigation or settlement of claims, or when it is easy for the public to insure itself against loss, or when the number and amount of claims would be excessive, the courts are less likely to declare individuals to be intended beneficiaries. But the service to be provided can be so tailored to the needs of particular persons that it makes sense to view them as intended beneficiaries.

Case 12.3

Kornblut v. Chevron Oil Co., 62 A.D.2d 831 (N.Y. 1978)

HOPKINS, J.

The plaintiff-respondent has recovered a judgment after a jury trial in the sum of $519,855.98 [about $2.6 million in 2024 dollars] including interest, costs and disbursements, against Chevron Oil Company (Chevron) and Lawrence Ettinger, Inc. (Ettinger) (hereafter collectively referred to as defendants) for damages arising from the death and injuries suffered by Fred Kornblut, her husband. The case went to the jury on the theory that the decedent was the third-party beneficiary of a contract between Chevron and the New York State Thruway Authority and a contract between Chevron and Ettinger.

On the afternoon of an extremely warm day in early August, 1970 the decedent was driving northward on the New York State Thruway. Near Sloatsburg, New York, at about 3:00 p.m., his automobile sustained a flat tire. At the time the decedent was accompanied by his wife and 12-year-old son. The decedent waited for assistance in the 92 degree temperature.

After about an hour a State Trooper, finding the disabled car, stopped and talked to the decedent. The trooper radioed Ettinger, which had the exclusive right to render service on the Thruway under an assignment of a contract between Chevron and the Thruway Authority. Thereafter, other State Troopers reported the disabled car and the decedent was told in each instance that he would receive assistance within 20 minutes.

Having not received any assistance by 6:00 p.m., the decedent attempted to change the tire himself. He finally succeeded, although he experienced difficulty and complained of chest pains to the point that his wife and son were compelled to lift the flat tire into the trunk of the automobile. The decedent drove the car to the next service area, where he was taken by ambulance to a hospital; his condition was later diagnosed as a myocardial infarction. He died 28 days later.

Plaintiff sued, inter alia, Chevron and Ettinger alleging in her complaint causes of action sounding in negligence and breach of contract. We need not consider the issue of negligence, since the Trial Judge instructed the jury only on the theory of breach of contract, and the plaintiff has recovered damages for wrongful death and the pain and suffering only on that theory.

We must look, then, to the terms of the contract sought to be enforced. Chevron agreed to provide “rapid and efficient roadside automotive service on a 24-hour basis from each gasoline service station facility for the areas…when informed by the authority or its police personnel of a disabled vehicle on the Thruway”. Chevron’s vehicles are required “to be used and operated in such a manner as will produce adequate service to the public, as determined in the authority’s sole judgment and discretion”. Chevron specifically covenanted that it would have “sufficient roadside automotive service vehicles, equipment and personnel to provide roadside automotive service to disabled vehicles within a maximum of thirty (30) minutes from the time a call is assigned to a service vehicle, subject to unavoidable delays due to extremely adverse weather conditions or traffic conditions.”…

In interpreting the contract, we must bear in mind the circumstances under which the parties bargained. The New York Thruway is a limited access toll highway, designed to move traffic at the highest legal speed, with the north and south lanes separated by green strips. Any disabled vehicle on the road impeding the flow of traffic may be a hazard and inconvenience to the other users. The income realized from tolls is generated from the expectation of the user that he will be able to travel swiftly and smoothly along the Thruway. Consequently, it is in the interest of the authority that disabled vehicles will be repaired or removed quickly to the end that any hazard and inconvenience will be minimized. Moreover, the design and purpose of the highway make difficult, if not impossible, the summoning of aid from garages not located on the Thruway. The movement of a large number of vehicles at high speed creates a risk to the operator of a vehicle who attempts to make his own repairs, as well as to the other users. These considerations clearly prompted the making of contracts with service organizations which would be located at points near in distance and time on the Thruway for the relief of distressed vehicles.

Thus, it is obvious that, although the authority had an interest in making provision for roadside calls through a contract, there was also a personal interest of the user served by the contract. Indeed, the contract provisions regulating the charges for calls and commanding refunds be paid directly to the user for overcharges, evince a protection and benefit extended to the user only. Hence, in the event of an overcharge, the user would be enabled to sue on the contract to obtain a recovery.…Here the contract contemplates an individual benefit for the breach running to the user.…

By choosing the theory of recovery based on contract, it became incumbent on the plaintiff to show that the injury was one which the defendants had reason to foresee as a probable result of the breach, under the ancient doctrine of Hadley v Baxendale [Citation], and the cases following it…in distinction to the requirement of proximate cause in tort actions.…

The death of the decedent on account of his exertion in the unusual heat of the midsummer day in changing the tire cannot be said to have been within the contemplation of the contracting parties as a reasonably foreseeable result of the failure of Chevron or its assignee to comply with the contract.…

The case comes down to this, then, in our view: though the decedent was the intended beneficiary to sue under certain provisions of the contract—such as the rate specified for services to be rendered—he was not the intended beneficiary to sue for consequential damages arising from personal injury because of a failure to render service promptly. Under these circumstances, the judgment must be reversed and the complaint dismissed, without costs or disbursements.

[Martuscello, J., concurred in the result but opined that the travelling public was not an intended beneficiary of the contract.]

Case questions

- Chevron made two arguments as to why it should not be liable for Mr. Kornblut’s death. What were they?

- Obviously, when Chevron made the contract with the New York State Thruway Authority, it did not know Mr. Kornblut was going to be using the highway. How could he, then, be an intended beneficiary of the contract?

- Why was Chevron not found liable for Mr. Kornblut’s death when, clearly, had it performed the contract properly, he would not have died?

Check your Understanding

the transfer of rights under a contract from one party to another party

the transfer to a third party of the duty to perform under a contract

a party that was considered at the time the contract was made, and is part of the purpose for the contract in the first place

a legal treatise from the second series of the Restatements of the Law which seeks to inform judges and lawyers about general principles of contract common law

one to whom the promisor agrees to pay a debt of the promisee

one who makes a promise

one to whom a promise is made

a direct beneficiary whom the party paying for the other party's performance intends to benefit as a gift or donation

a third-party beneficiary to a contract whom the parties to the contract did not intend to benefit